What is WACC

Weighted average cost of capital is a financial metric used to calculate the average cost of capital for a company. WACC takes into account the proportional weight of each type of capital (debt and equity) in a company’s capital structure and combines their respective costs.

Why WACC is important for valuations

WACC is applied in valuations because it represents the minimum rate of return that a company needs to earn on its investments to satisfy its investors and lenders. When valuing a company, the WACC is used as a discount rate to determine the present value of its future cash flows.

Here are a few reasons why WACC is applied in valuations:

Cost of Capital: WACC reflects the cost of both debt and equity capital used by a company. It considers the interest payments on debt and the required return on equity. By incorporating both these components, WACC provides a comprehensive measure of the cost of capital for the company.

Time Value of Money: WACC recognizes the time value of money by discounting future cash flows back to their present value. It considers that money received in the future is worth less than the same amount received today. By discounting cash flows at the appropriate WACC, the valuation accounts for the time value of money.

Risk and Return: WACC takes into account the risk associated with a company’s capital structure. The cost of debt reflects the risk of default, and the cost of equity captures the risk premium required by investors. By incorporating these risk factors, WACC reflects the overall risk and return expectations of the company.

Capital Budgeting: WACC is used as a discount rate in capital budgeting decisions. When evaluating investment projects, the cash flows generated by the project are discounted at the WACC to determine their present value. If the projected cash flows exceed the project’s present value, it is considered a worthwhile investment.

Company Valuation: WACC is employed in various valuation techniques like discounted cash flow (DCF) analysis or the residual income model. These valuation methods estimate the intrinsic value of a company by discounting its expected future cash flows at the appropriate WACC. The resulting present value represents the estimated value of the company.

How to estimate WACC

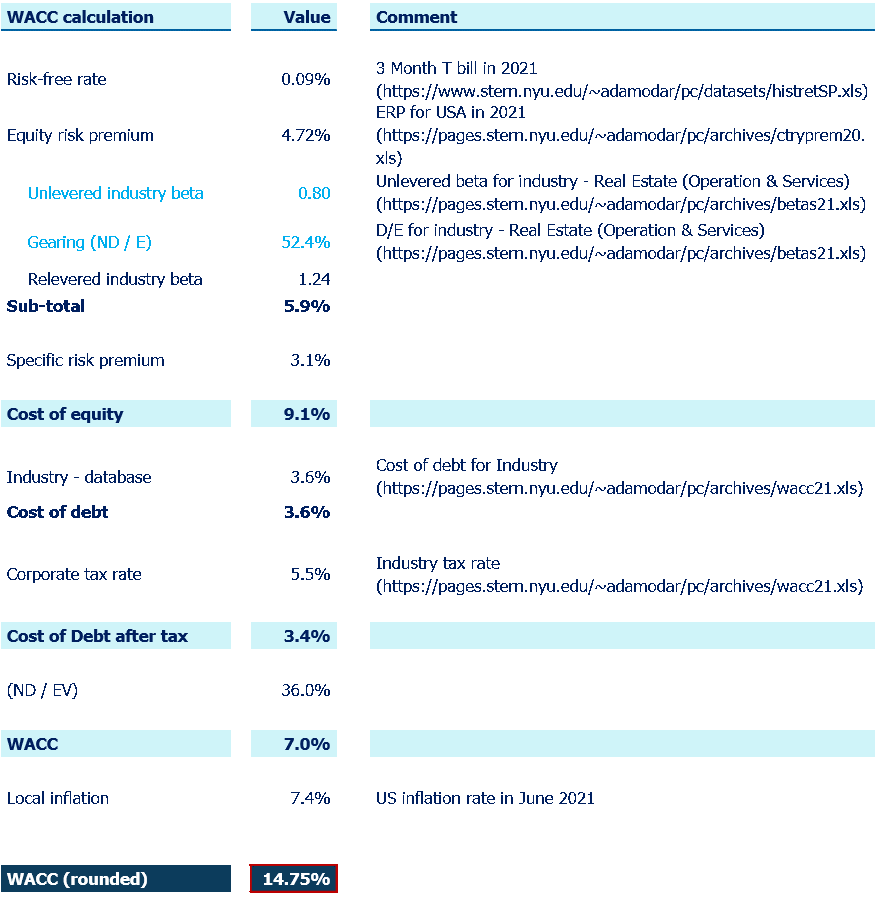

This is an example of WACC calculation.

Let’s see what is included.

How we calculated the WACC in this example?

We calculated the weighted average cost of capital (WACC) according to the formula:

WACC=Ke* E/(D+E)+Kd* D/(D+E)

Abbreviations:

Ke – Cost of equity

E (Equity) – the market value of equity

Kd (Cost of debt after tax) – net cost of debt, i.e. gross cost of debt minus tax savings

D (Debt) – the market value of debt

D+E – enterprise value

To calculate the required rate of return on equity, we used data from a personal web-site of Aswath Damodaran, Professor of Corporate Finance and Valuation at the Stern Business School at New York University who is one of the most influential experts in business finance in the world

(http://pages.stern.nyu.edu/~adamodar/). The data from these websites are free and used by consulting companies around the world.

Cost of equity

The calculation of the cost of equity is calculated according to the formula using the CAPM model:

Ke=RFR+BC*ERP+SRP

Abbreviations:

RFR – Risk free rate

BC – Beta Coefficient

ERP – Equity risk premium

SRP – Specific risk premium

As the rate of return on risk-free investments, we used the yield to maturity of US 3-month T bills in 2021, which was 0.05%.

The equity risk premium represents the rate of return that an investor would achieve by investing in a market portfolio (a certain stock index). The equity risk premium was calculated on the basis of current prices on financial markets (implied ERP), based on data from Damodaran’s database for 2021. The equity risk premium is 4.72%.

The beta coefficient

The beta coefficient is a coefficient that represents a measure of the correlation of return on investments in a certain industry in relation to the return on investments in the market portfolio.

The product of the beta coefficient and the equity risk premium represent the premium on investment in a certain industry. If the beta coefficient is less than 1, the premium to invest in that industry is lower than the premium on market return, so we can say that investing in that industry is less risky than investing in a market portfolio.

If the beta coefficient is higher than 1, the premium to invest in that industry is higher than the premium on a market portfolio, so we can say that investing in that industry is riskier than investing in a market portfolio.

The beta coefficient (BC) is calculated according to the following formula:

𝑩𝑪=𝑩𝒖∗(𝟏+(𝟏−𝑻𝒄)∗ 𝑫/𝑬)

Abbreviations:

Bu – Beta ratio for a company that is fully financed from equity (Unlevered beta); Bu is specific to each industry. For the sector in which the Company operates (Real Estate (Operation & Services) for the USA, according to the data for 2021, Bu is 0.81

Tc – marginal income tax rate (we took effective tax rate for the sector in which the Company operates (Real Estate (Operation & Services) for the USA of 5.5%)

D/E- target ratio of debt and equity. For the industry in which the Company operates, for the area of the USA, according to data from 2021 D/E is 56.4%)

BC – revered industry beta, with financial leverage effect included. BC is 1.24

On these components, we added a specific risk premium of 3.2%.

After we have calculated all the necessary data for the calculation by applying the formula for calculating the required cost of equity, we obtain the cost of equity of 9.1%.

The cost of debt

The cost of debt after tax (Kd) is calculated according to the following formula:

Kd=Km*(1-Tc)

Abbreviations:

Km – the marginal (gross) cost of debt: cost of debt for US companies from the same industry (Real Estate (Operation & Services) is 3.6%

Tc- marginal profit tax rate: the effective tax rate for US companies from the same industry (Real Estate (Operation & Services) is 5.5%

By applying the above formula for calculating the net interest rate, we get a cost of debt after tax of 3.4%.

To calculate the real discount rate (WACC), the rest is to calculate the shares of the market value of debt and equity in enterprise value.

The share of the market value of debt in enterprise value is calculated by the formula:

D/(D+E)= (D/E)/(1+ D/E)

The share of the market value of debt is 36.0%.

Therefore, the share of the market value of equity is 64.0%.

After we have calculated all the necessary data, according to the previously mentioned formula for WACC, we obtain a real discount rate of 7.0%.

However, since nominal cash flows were used in projections, we increased WACC real rate for inflation to get to WACC nominal rate.

The nominal WACC rate was calculated by the formula:

WACCn=WACCr*(1+IR)

Abbreviations:

WACCr – WACC real rate which we calculated before (7.0%)

IR – US inflation rate in June 2021 (5.4%) – presented in a graph below

WACCn – WACC nominal rate

Applying the formula above, we come to a WACC nominal rate of 12.75%, which will be used for discounting the projected cash flows of the Company.