DCF valuation, or discounted cash flow valuation, is a financial modeling technique used to estimate the intrinsic value of an investment based on its expected future cash flows. The method involves projecting the future cash flows of an investment and discounting them back to their present value using a discount rate that reflects the risk of the investment. DCF valuation is widely used in financial analysis and investment decision-making, particularly in valuing companies, projects, and other investments.

Importance of DCF valuation

- Provides a comprehensive view of the investment: DCF business valuation considers multiple factors such as future cash flows, discount rates, and terminal values to estimate the intrinsic value of a business. It provides a comprehensive view of the investment, considering not only current performance but also future expectations.

- Helps in decision-making: DCF business valuation is an essential tool for decision-making in various areas such as mergers and acquisitions, investment analysis, and capital budgeting. It enables investors to compare different investment opportunities and make informed decisions based on their estimated intrinsic value.

- Helps in negotiations: DCF business valuation is often used in negotiations, such as during the sale of a business or in disputes between partners. The estimated intrinsic value of the business provides a starting point for negotiations and helps the parties to come to a fair agreement.

- Provides insights into the business: DCF business valuation requires a detailed analysis of the business’s financials and operations. This analysis provides insights into the company’s strengths and weaknesses, which can be used to identify areas for improvement and growth opportunities.

Step-by-Step Guide to DCF Valuation

Step 1: Historical financial statements analysis

Historical financial statements analysis is a method of evaluating a company’s financial performance over time by analyzing its past financial statements. The analysis involves examining a company’s income statement, balance sheet, and cash flow statement to identify trends and patterns in its financial performance.

The analysis typically involves comparing financial data from multiple periods to identify changes in revenue, expenses, assets, liabilities, and cash flows. By analyzing these changes, investors can gain insights into the company’s financial health and identify areas of strength and weakness.

Historical financial statements analysis is an important tool for investors and analysts because it provides a historical record of a company’s financial performance and can help to identify trends and patterns that may be relevant for forecasting future performance.

Historical financial statements analysis provides the data needed to build forecasting models. By analyzing past performance, investors can identify key drivers of future performance, which can be used in forecasting models to estimate future results. Accordingly, historical analysis is important for the next step of DCF valuation.

Step 2: Forecast of income statement

Revenue forecast

Forecasting revenue is a critical component of any financial valuation model. Here are some steps to help you forecast revenue for a valuation financial model:

- Identify key drivers: The first step is to identify the key drivers of revenue for the business. These may include factors such as market size, market share, pricing, and customer acquisition.

- Gather data: Collect data on historical revenue performance and the drivers identified in the first step. This data can be obtained from the company’s financial statements, industry reports, or other sources.

- Analyze trends: Analyze the historical data to identify trends and patterns in revenue performance and the drivers identified in the first step. This analysis can help you to identify any seasonality, growth rates, or other trends that may impact future performance.

- Develop assumptions: Based on the analysis of historical data, develop assumptions about future performance. These assumptions should be based on realistic expectations and take into account any external factors that may impact revenue, such as changes in the market or competitive landscape.

- Create a forecast: Use the assumptions developed in the previous step to create a revenue forecast for the forecast period. This forecast should be based on realistic assumptions and take into account any external factors that may impact revenue.

- Sensitivity analysis: Perform sensitivity analysis on the revenue forecast to test the impact of changes in key drivers or assumptions. This will help you to identify any risks or opportunities that may impact the valuation of the business.

COGS forecast

Basics steps to help you forecast COGS for valuation purposes:

Identify the components of COGS: The first step is to identify the components of COGS, which typically include direct materials, direct labor, and overhead costs.

Gather data: Collect data on historical COGS performance and the components identified in the first step. This data can be obtained from the company’s financial statements, industry reports, or other sources. For COGS forecast the most important metric is % of cogs in Revenue.

Analyze trends: Analyze the historical data i.e. COGS share in revenue. This analysis can help you to identify any seasonality, growth rates, or other trends that may impact future performance.

Develop assumptions: Based on the analysis of historical data, develop assumptions about future performance.

OPEX forecast

Operating expenses are the ongoing costs associated with running a business, which are not directly related to the production of goods or services. Examples of opex include rent, utilities, salaries, marketing expenses, and other general and administrative expenses. Operating expenses are deducted from a company’s revenue to calculate its operating income or earnings before interest, taxes, depreciation, and amortization (EBITDA). Accurately forecasting and managing operating expenses is important for businesses to maintain profitability and financial stability.

For the purpose of DCF valuation, OPEX are to be forecasted based on its historical share in total revenues adjusted for some assumptions such as expected change in salaries or rent, for example.

EBITDA Forecast

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a financial metric used to measure a company’s operating performance by calculating its earnings before non-operating expenses such as interest, taxes, depreciation, and amortization are taken into account.

Calculate EBITDA as the difference between revenue and COGS / operating expenses.

Interest expense forecast

You can make an interest expense forecast based on both: current loan payment plan and new expected loans with assumed interest rates.

Depreciation forecast

To make a depreciation forecast for a valuation model, you need to consider the following:

- Identify assets: Start by identifying the assets that will be depreciated. This includes both tangible assets (such as machinery and equipment) and intangible assets (such as patents and copyrights).

- Determine useful life: Determine the useful life of each asset. This is the estimated period over which the asset will be used in the business before it becomes obsolete or needs to be replaced.

- Choose a depreciation method: Choose a depreciation method that is appropriate for each asset. Common methods include straight-line depreciation, accelerated depreciation, and units of production depreciation.

- Calculate depreciation expense: Calculate the depreciation expense for each asset using the chosen depreciation method. This will give you the amount of depreciation that will be recorded each period.

Corporate tax forecast

Just apply the corporate tax rate on the net result before taxation calculated based on the steps above. (total revenues minus total expenses)

Net result forecast

Calculate net result after taxation by deducting corporate taxes from net result before taxation.

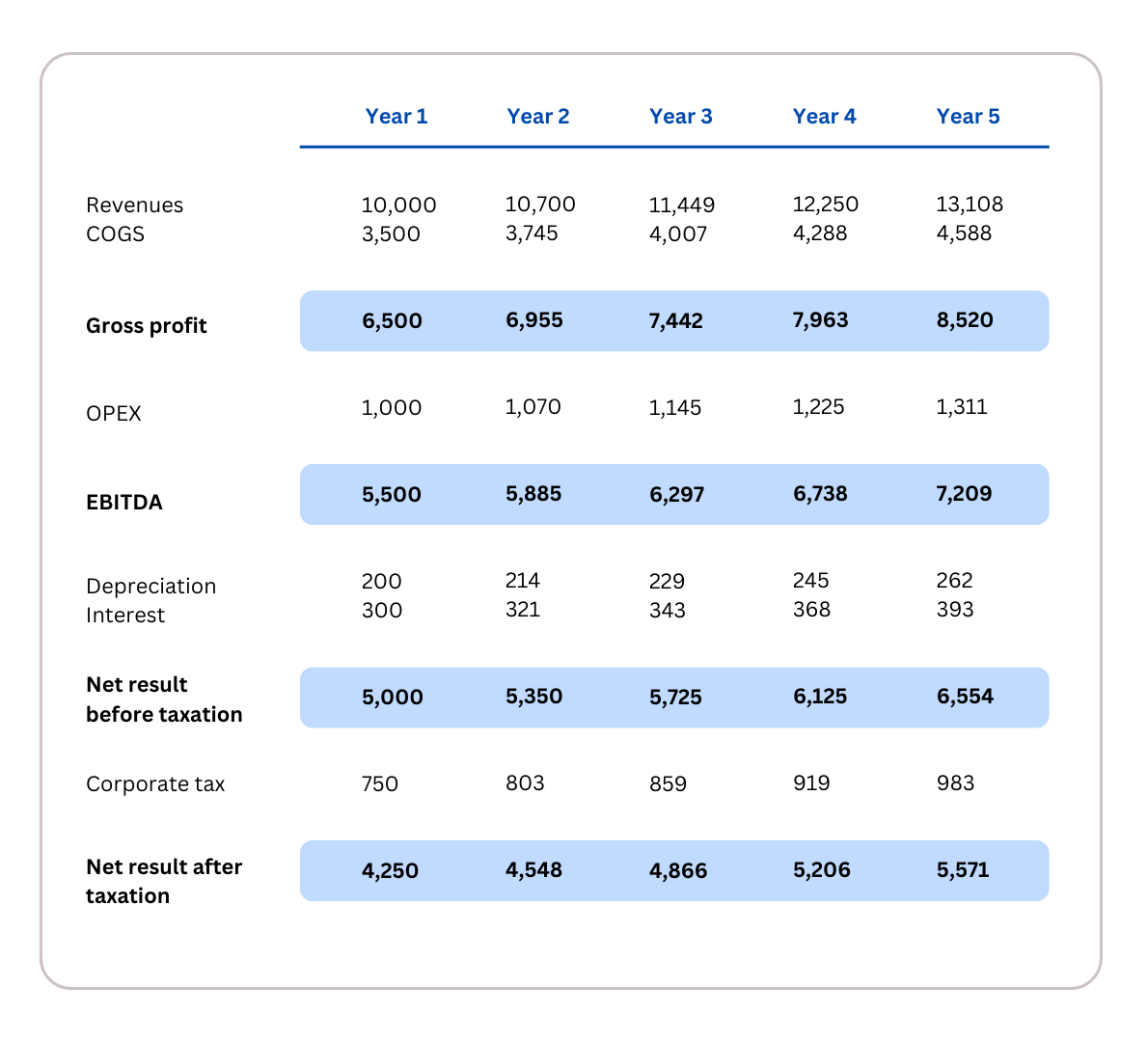

Summary of income statement forecast

Step 3: Forecast of net working capital

Start by identifying the current level of working capital. This includes current assets such as accounts receivable (AR), inventory (I), as well as current liabilities such as accounts payable and accrued expenses.

NWC = AR + I – AP

- Calculate AR based on revenue forecast and assumed days sales outstanding.

- Calculate I based on revenue forecast and assumed days inventories outstanding.

- Calculate AP based on revenue forecast and assumed days payables outstanding.

Step 4: CAPEX forecast

Forecasting capital expenditures (capex) is an important part of the valuation modeling process, as it allows businesses to plan for and manage their investment in long-term assets. Here’s a brief overview of how to forecast capex:

- Identify assets: Start by identifying the assets that will require capital expenditures. This includes both tangible assets (such as buildings, equipment, and machinery) and intangible assets (such as patents and software).

- Determine useful life: Determine the useful life of each asset. This is the estimated period over which the asset will be used in the business before it becomes obsolete or needs to be replaced.

- Estimate cost: Estimate the cost of acquiring and installing each asset. This will include not only the purchase price but also any additional costs associated with installation, such as labor, transportation, and permits.

Create a capex schedule: Create a capex schedule that shows the expected timing and amount of each capital expenditure. This will allow you to plan for and manage the cash outflows associated with these investments

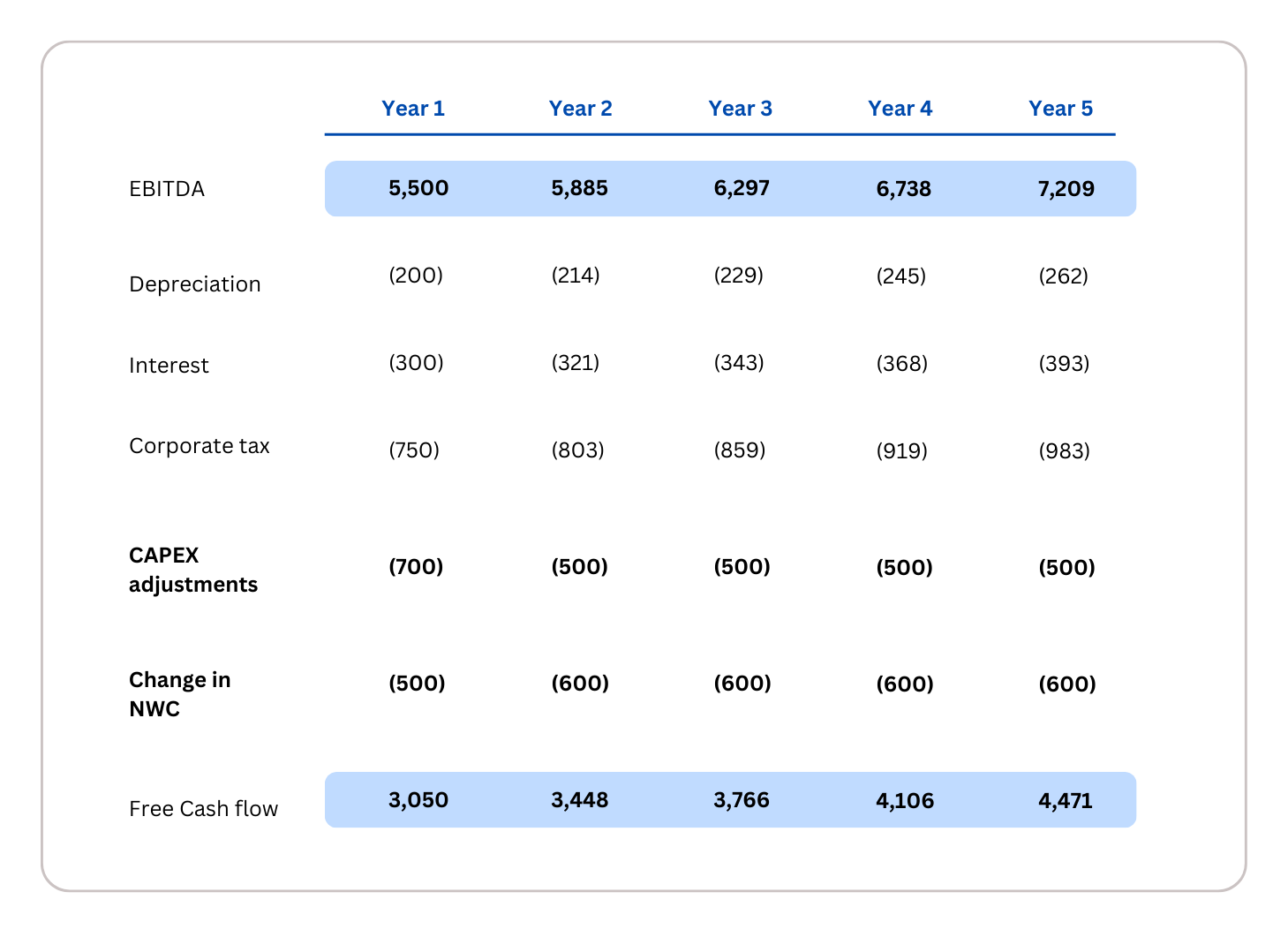

Step 5: Forecasting Cash Flows

Once you have all the above forecasts done, now you can make simple cash flow forecast calculations for your valuation:

Step 6: Determining the Discount Rate

The cost of equity is the expected rate of return that shareholders require to invest in a company’s common equity. In other words, it is the return that investors expect to receive on their investment in the form of dividends and capital gains.

When conducting a valuation, the cost of equity is an important factor to consider as it reflects the investors’ perception of risk associated with the company’s future earnings. A higher risk perception means a higher cost of equity, and vice versa.

For the purpose of DCF valuation usually the weighted average cost of capital (WACC) is used.

The WACC formula takes into account the cost of equity, the cost of debt, and the proportion of equity and debt in the company’s capital structure

Step 7: Determining The Long Term Growth Rate

The terminal period growth rate represents the growth rate that a company is expected to achieve beyond the forecast period. The terminal period is typically the last year of the forecast period, and the growth rate used in the terminal period is known as the terminal growth rate.

Here are a few methods to consider when determining the terminal period growth rate:

- Industry Growth Rates: One method is to use the growth rates for the industry the company operates in and use that as a benchmark for the terminal growth rate. This can help ensure that the growth rate is realistic and achievable.

- Historical Growth Rates: Another method is to look at the company’s historical growth rates over a certain period of time and use that as a basis for the terminal growth rate. However, it is important to consider if those growth rates are sustainable in the future.

- Analyst Estimates: You can also consider estimates from industry analysts for the terminal growth rate. These estimates are based on research and analysis of the company’s industry and financial performance.

- Management Guidance: Finally, you can look at guidance from the company’s management on their expectations for future growth. This can provide insight into the company’s plans and strategies for the future.

Step 8: Calculating the Terminal Value

The terminal value is the estimated value of a company beyond the explicit forecast period used in a discounted cash flow (DCF) analysis. In DCF valuation, the cash flows beyond the explicit forecast period are often uncertain and difficult to estimate. Therefore, a terminal value is used to estimate the value of the company beyond that explicit forecast period.

The terminal value is usually calculated by applying a multiple to the expected cash flows in the final year of the explicit forecast period. This multiple is typically based on the company’s expected long-term growth rate and the required rate of return by investors.

Step 9: Discounting Cash Flows and Terminal Value

You can do this in a few steps:

For the forecasting period, apply the discount rate to the estimated free cash flows to determine their present value. This involves dividing the estimated free cash flows by (1 + discount rate) raised to the power of the number of years in the forecast period.

For the terminal period, apply the discount rate to the terminal value to determine its present value.

Step 10: Calculating the Enterprise value

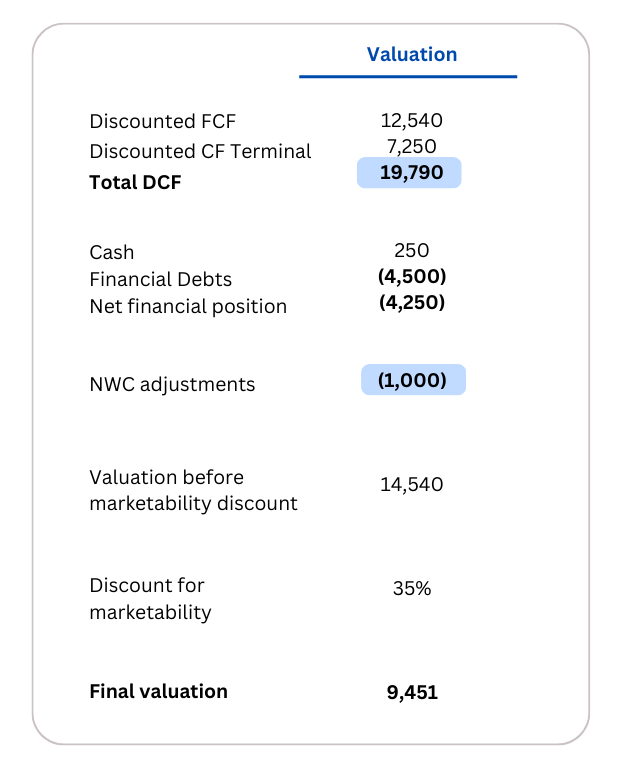

In this step, you need to sum the present value of the free cash flows and the present value of the terminal value to arrive at the DCF value of the company

Step 11: Adjustment for Net financial position

The net financial position represents the difference between a company’s financial liabilities (such as debt) and its financial assets (such as cash and marketable securities). If a company has a positive net financial position, it means that its financial assets are greater than its financial liabilities, while a negative net financial position indicates the opposite.

When valuing a company using DCF analysis, the net financial position is typically subtracted from the total equity value of the company. This is because the net financial position represents the amount of cash or financial assets that could be used to pay off debt or invest in other opportunities, which is not reflected in the company’s equity value.

By reducing the DCF value by the net financial position, analysts aim to arrive at a more accurate valuation of the company’s equity.

Step 12: Adjustment for Discount of Marketability

Marketability discount, also known as a lack of marketability discount (LOMD), is a reduction in the value of an asset or investment that is difficult to sell or convert into cash quickly, such as private equity or a privately-held business.

When valuing an illiquid asset, such as a private company, the marketability discount reflects the fact that there are fewer potential buyers for the asset, which makes it more difficult to sell and increases the risk of holding the asset. Investors who are willing to buy such an asset may require a discount on the price to compensate them for the additional risks and costs associated with holding the asset.

The marketability discount is typically expressed as a percentage reduction in the fair market value of the asset. The size of the discount can vary depending on several factors, including the size and complexity of the asset, the industry it operates in, the level of control and ownership of the asset, and the current market conditions.

Step 13: Final equity value calculation

Based on the steps above, your valuation will look like this:

Step 14: Sensitivity analysis

Sensitivity analysis is an important step in the DCF valuation process as it helps to assess the impact of changes in key assumptions on the overall valuation of a company.

DCF valuation involves making a number of assumptions about the future performance of a company, such as revenue growth rates, operating expenses, and capital expenditures. These assumptions are typically based on historical performance, industry trends, and management guidance. However, there is always a degree of uncertainty in these assumptions, and they may not always turn out to be accurate.

Sensitivity analysis involves changing one or more of these key assumptions and observing how the change affects the overall valuation of the company. This helps to identify the assumptions that have the greatest impact on the valuation and also highlights areas of uncertainty that require further investigation or analysis.

For example, if the valuation of a company is highly sensitive to changes in revenue growth rates, this may indicate that the company’s revenue projections are uncertain or that the industry in which it operates is volatile. Alternatively, if the valuation is highly sensitive to changes in the discount rate, this may indicate that the company’s risk profile is higher than initially assumed.

By performing sensitivity analysis, analysts can gain a better understanding of the underlying assumptions and risks associated with a DCF valuation and can make more informed investment decisions. It also helps to ensure that the valuation is robust and takes into account a range of potential outcomes, rather than relying on a single set of assumptions.

Advantages and Disadvantages of DCF Valuation

Advantages

- Comprehensive approach: DCF valuation takes a comprehensive approach to valuation, taking into account all future cash flows and discounting them to their present value.

- Flexibility: DCF valuation is a flexible method that can be tailored to different types of assets or businesses, and it can incorporate a wide range of assumptions and inputs.

- Future-oriented: DCF valuation is forward-looking, as it focuses on the future cash flows that a business is expected to generate. This allows investors to assess the long-term potential of a business.

- Sensitivity analysis: DCF valuation allows for sensitivity analysis, which enables investors to test the impact of changes in assumptions and inputs on the valuation.

Disadvantages

- Assumption-driven: DCF valuation heavily relies on assumptions and estimates, such as the future growth rate, discount rate, and terminal value. These assumptions can be subjective and uncertain, which can impact the accuracy of the valuation.

- Time-consuming: DCF valuation is a time-consuming method, as it requires a detailed analysis of a business’s financial statements and a thorough understanding of its operations.

- Limited historical data: DCF valuation is based on future cash flows, which means that it is not as reliable for businesses with limited historical financial data or that operate in new or emerging industries.

- Sensitivity to inputs: DCF valuation is sensitive to changes in assumptions and inputs, which can have a significant impact on the final valuation. This means that investors need to carefully consider and test the inputs used in the valuation.

DCF Valuation FAQ

here are some frequently asked questions about DCF valuation:

Q: What is DCF valuation?

DCF valuation, or discounted cash flow valuation, is a method used to estimate the value of an investment based on its future cash flows. It involves projecting future cash flows and discounting them back to the present using a discount rate.

Q: How does DCF valuation work?

DCF valuation works by estimating the future cash flows of an investment, discounting them back to their present value using a discount rate that reflects the risk of the investment, and then summing up these present values to arrive at an estimate of the investment’s intrinsic value.

Q: What are the key components of DCF valuation?

The key components of DCF valuation are cash flows, discount rates, and terminal values. Cash flows represent the expected future cash inflows and outflows of the investment. The discount rate represents the risk-adjusted opportunity cost of capital required to invest in the investment. The terminal value represents the value of the investment at the end of the projection period.

Q: What is the difference between WACC and cost of equity?

The WACC, or weighted average cost of capital, represents the blended cost of financing for a company, taking into account both debt and equity financing. The cost of equity, on the other hand, represents the required rate of return that investors demand for investing in the company’s equity.

Q: What are the advantages of DCF valuation?

The advantages of DCF valuation include its ability to capture the time value of money, its flexibility in incorporating changes in assumptions, and its focus on cash flows, which are considered a more reliable measure of value than accounting profits.

Q: What are the disadvantages of DCF valuation?

The disadvantages of DCF valuation include its sensitivity to assumptions, the difficulty of forecasting future cash flows accurately, and the potential for subjective bias in selecting a discount rate and other assumptions.

Q: What are some common applications of DCF valuation?

DCF valuation is commonly used in valuing companies, projects, real estate, and other investments. It is also used in financial modeling, capital budgeting, and investment analysis.

Still Need a Help Form Experts?

Whether you are a business owner, investor, or financial professional, a comprehensive DCF valuation can provide valuable insights into the value of your assets or the investment opportunities available to you.

At our firm, we specialize in providing accurate and reliable DCF valuation services to clients across industries. Our team of experienced professionals has the skills and expertise needed to conduct a thorough analysis of your business or asset, taking into account all relevant factors and assumptions.

With our DCF valuation services, you can gain a clear understanding of the potential risks and rewards associated with your investments, and make informed decisions about your financial future.

So don’t wait – contact us today to learn more about how we can help you achieve your valuation goals.