In this article, we are going to explain the essential rules of the benchmarking study as part of the transfer pricing file. Let us begin with one example.

Few weeks ago, one of my transfer pricing clients called me, after we delivered a benchmarking study:

“Thank you for your benchmarking study. I see that you identified some of the German independent companies, comparable with our business. But, we provide a very specific type of services in France, I am not sure if there are any comparable companies in Germany. Still, some comparable companies do not perform exact service like us”

In discussion with your transfer pricing consultant or tax advisor, have you ever asked similar questions?

The goal of this text is to try to explain to you how benchmarking study in transfer pricing should be done. After reading this, you should have a clearer understanding of whether your consultant performed a benchmarking study in transfer pricing well or not. Remember that in OECD Guidelines it is mentioned that transfer pricing is not an exact science.

Benchmarking study – Why we do it anyway?

The goals of the benchmarking study in transfer pricing are:

- First goal is to identify independent comparable companies. Please note that you need to identify companies comparable to the controlled transaction (i.e. transaction between the client and related party), not to the company itself. Your company is a subsidiary of a multinational online retailer. Parent company charges your management fee with 5% mark-up. For the transaction of the management fee, you should not identify comparable online retailers. You should identify service companies, which provide services charged in the management fee

- Second goal is to calculate the profit margins of independent companies. Usually, EBIT margins should be calculated, but it depends on the selected transfer pricing method and preferred PLI (profit level indicator)

- Next step is to make potential adjustments of PLI calculation in controlled transaction in order to achieve a high level of functional comparability

- Comparing margin in the controlled transaction with margins of independent companies. After that, the conclusion should be made whether adjustment (correction) of the tax base is necessary or not (Are your transfer prices in line with “arm’s length principle”)

The first step is crucial, the rest is more or less routine. Therefore, we’ll now move on to describe the first goal in more detail.

How to identify independent comparable companies?

Good consulting work is the result of partnership between the consultant and the client. The Consultant provides its specialised expertise. On the other hand, the client provides its knowledge on the business and the industry. The same applies to identifying independent comparable companies. You need to do this together. What are the key activities done?

Analysis of the client’s business

Consultant should understand your line of work:

- What is the business model? How does the client make a profit?

- In what industry does the client operate? Describe the industry. Which are the main trends on the market?

- Who are the client’s most significant competitors (on the national and global market)?

- What are the main regulatory factors affecting the client’s business?

This is preparatory work. Consultant needs to understand the wider context in which you operate.

Understand the controlled transaction

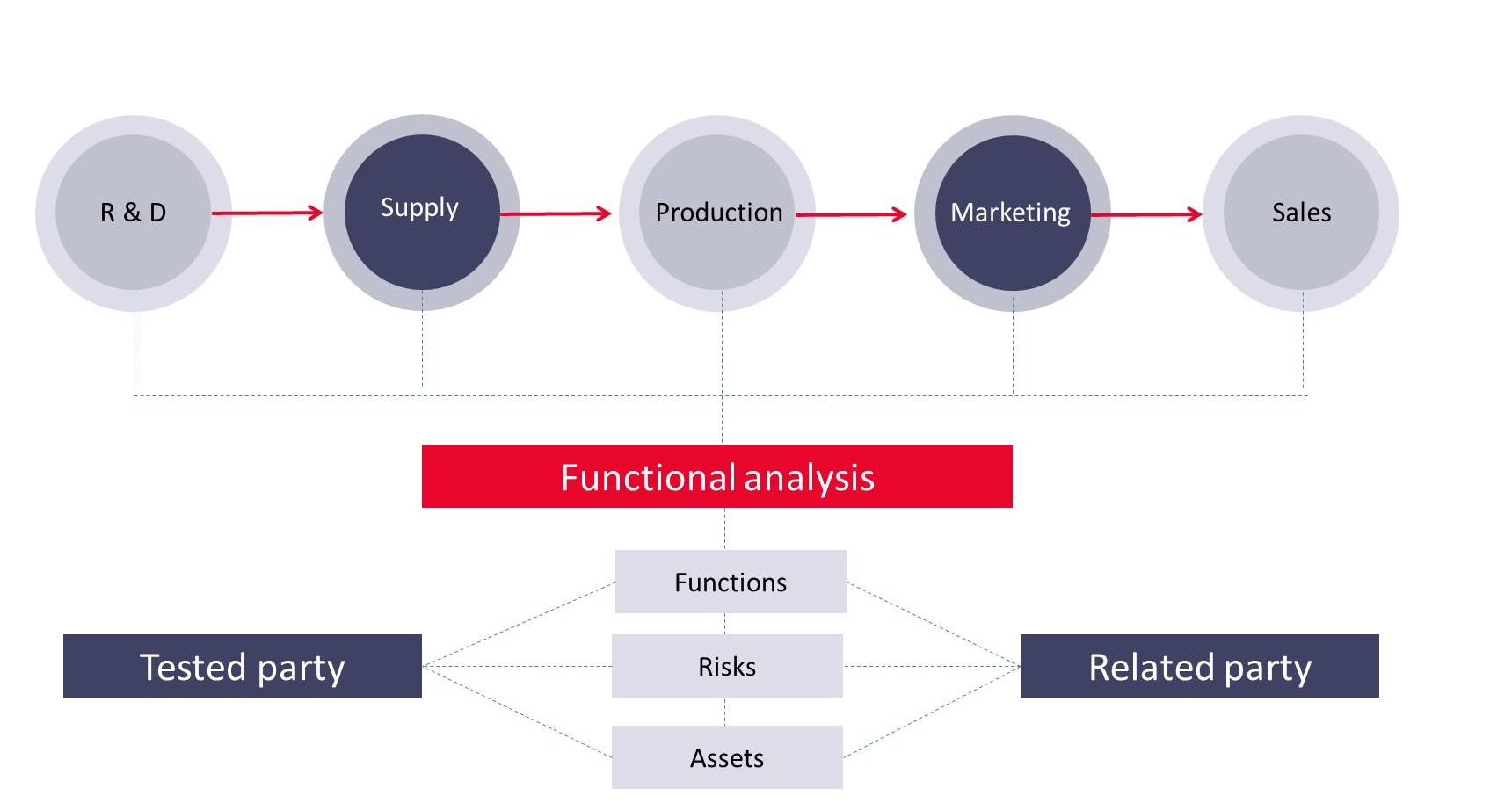

Before diving into the details of the controlled transaction, the consultant needs to take a step back. To look at the bigger picture. The picture is the consolidated value chain of the client’s group. Good consultants will identify the controlled transaction in the value chain of the whole group. It is crucial to understand what are the main benefits of the controlled transaction to the whole group, i.e. how it helps to generate the group’s consolidated profit.

The next activity is to perform a thorough analysis of the controlled transaction:

- What is exchanged in the transaction? Is it goods, services, property, what is it?

- Understand the functional profiles of both parties. What activities are undertaken? Which assets are engaged? What are the main risks? How are activities, assets, and risks divided between the parties?

- Analyse the contractual terms (verbal or written) between the parties. Is the contract implemented in practice?

- Understand the market conditions of the transaction. If the client is charged with a management fee from the parent company, ask the question: What were the alternatives for the client? Could it be purchased from an independent service provider? Or could it be performed internally?

- What are the business strategies of related parties?

The end result is the prototype of a comparable company. We need to answer the question:

What is the independent company that enters into comparable transactions within its regular business?

The answer to the client’s concern

We have explained how to identify the prototype of an independent comparable company. Now, let us go back to the client’s comment from the beginning of the text. Is my benchmarking study well prepared or client is right?

I was aware that the client’s services are very distinct. The client is a software development centre for a parent company. Client’s employees work on a type of software which is state-of-the-art, not many French companies develop them (if there is a single one). So, the first step was to expand geographic reach, to search through the most similar markets.

Plus remember that I need to find independent companies. I cannot use either multinational companies or local companies with related parties (operating in France) as comparable companies.

So, what did I do?

I decided to focus less on the subject of the transaction (it was enough for me that a comparable company provides software development/computer programming services), but to pay attention to other comparability factors:

- Functional profile of the company: my aim was to find companies who operate as independent development centres for their clients. Those companies do not market their solution, they are only service providers. Clients market the solution themselves

- Market conditions and business strategies: I was looking for those who position themselves in a similar manner my client does

When identifying comparable companies, you must be aware that you cannot find an exact replica. Just like people, each one is unique. But, what you can do is to find the most similar, having in mind all limitations and circumstances.

Additive approach in benchmarking study

In OECD Guidelines, two main approaches in benchmarking study are recognized (which are not mutually exclusive):

- Additive approach

- Deductive approach

The additive approach consists of drawing up a list of potentially comparable companies, for example, the client’s competitors. The list is usually prepared through joint effort of consultant and client. Then you go through the list and see which company could be picked as a comparable.

The main challenge with the additive approach is that you may not have enough data on potentially comparable companies, mainly:

- Can you conclude if the company does not have related parties?

- Are there available financial data so you may calculate profit margins?

Deductive approach in benchmarking study

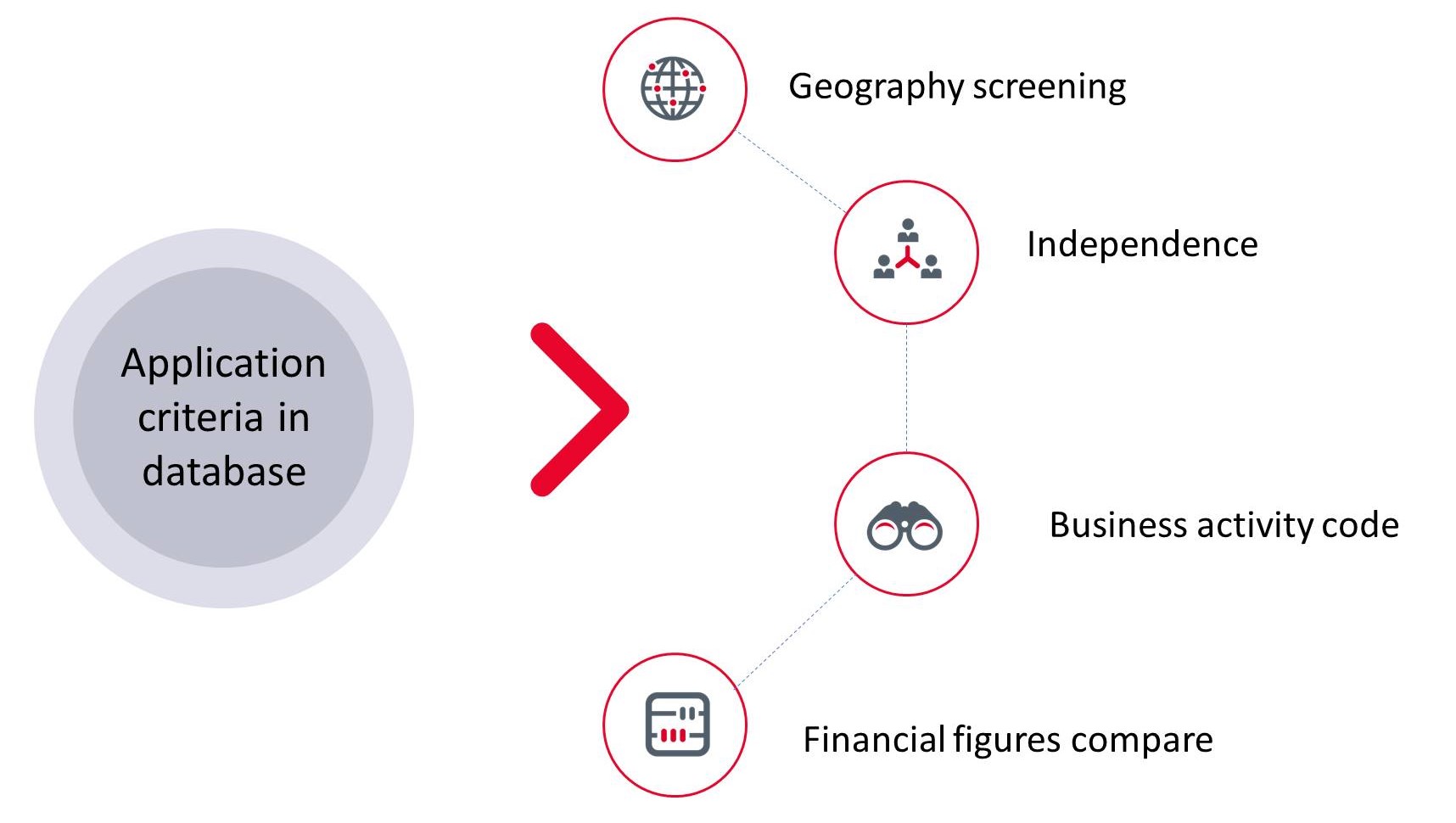

Deductive approach is performed almost solely by the consultant. The deductive approach starts with a wide set of companies operating in the same sector (NACE Rev 2. Business activity code), established using domestic or international databases.

Let us just repeat: you need to identify companies comparable to the controlled transaction (i.e. transaction between the client and related party), not to the company itself. If the controlled transaction is from the company’s core business activity, you may look for firms comparable to the client itself. But, if the client is engaged in the wholesale of computer equipment, and provides accounting services to a related party, the goal of the benchmarking study is to identify accounting firms, not computer wholesalers.

Each database, domestic or international, allows the formation of a sample of potentially comparable companies, using criteria such as:

- Ownership structure and independence criteria: eliminating companies that have related parties from the search

- Year of incorporation: excluding start-up companies, because they are facing significant business start-up investments and costs

- Geography screening: start from the client’s country and then expand geographic region to countries with similar market conditions, if necessary

- NACE Rev 2. Business activity code: select the activity code according to the nature of the transaction being tested

- Turnover: exclude small companies from the sample

In our experience, the optimal number of potentially comparable companies in most cases is around 100. A smaller sample leads to the danger of not finding a sufficient number of companies, and a larger sample often takes valuable time unnecessarily. Finally, a database means nothing with a relevant search strategy according to the basic transfer pricing principles.

Qualitative analysis

Once the sample is formed, we perform a qualitative search. By searching websites and other publicly available information, we determine whether companies are independent and whether they enter into transactions similar to the tested one.

When examining potentially comparable companies, it is not enough just to analyse their activities, but it is necessary to analyse the website, financial statements, and other publicly available information to get a picture of their comparability:

- What is the degree of engagement of fixed assets?

- Do they engage significant net working capital?

- Are they exposed to similar market conditions as a client (similar level of product / service specialization, similar target market segment, similar product / service placement market, etc.)?

Wrap-up – did the consultant do his/her work?

Alright, we have gone through the main issues on benchmarking study in the transfer pricing compliance process. Now let us go back to the goal of the text, I’ll rephrase it a little bit, but keep the essence:

Has my consultant prepared a good benchmarking study for my transfer pricing file?

Go through the main steps of the benchmarking study that is part of the transfer pricing file, discuss it with your consultant. Has he or she understood your business and your controlled transaction? What were his/her assumptions in preparing the benchmarking study? Maybe he or she did do a great job, but you did not understand the results of the process. Or maybe you did not provide your consultant with adequate information on the transaction.

Each benchmarking study is a story. The story answers the question: What is the model of a comparable company? If you adapt the model, the story gets different. Many times, the client actually does not have problems with the process and procedures of the benchmarking study, but with the story.

Why engage us to prepare a transfer pricing benchmarking study?

We are one of the leading transfer pricing practices in the region, preparing benchmarking studies for both domestic and multinational companies from various industries, both large and small. We can provide you with our distinct approach, with the following attributes:

- Transfer pricing methodology aligned with OECD Guidelines

- Our approach begins with a broad understanding of the place of the controlled transaction in the value chain in the group’s value chain

- Experience in preparing benchmarking studies for many types of industries (technology and software development, services, agriculture, industry, wholesale, retail, etc.)

- More than 1.000 prepared benchmarking studies for transfer pricing purposes

- Benchmark study costs are in line with your expectations

We trust this article would help you acquire a better understanding of benchmarking study preparation for the purpose of full transfer pricing compliance. In case you need professional support from our transfer pricing consultant, do not hesitate to write to our consultants.