Process of company registration in Serbia

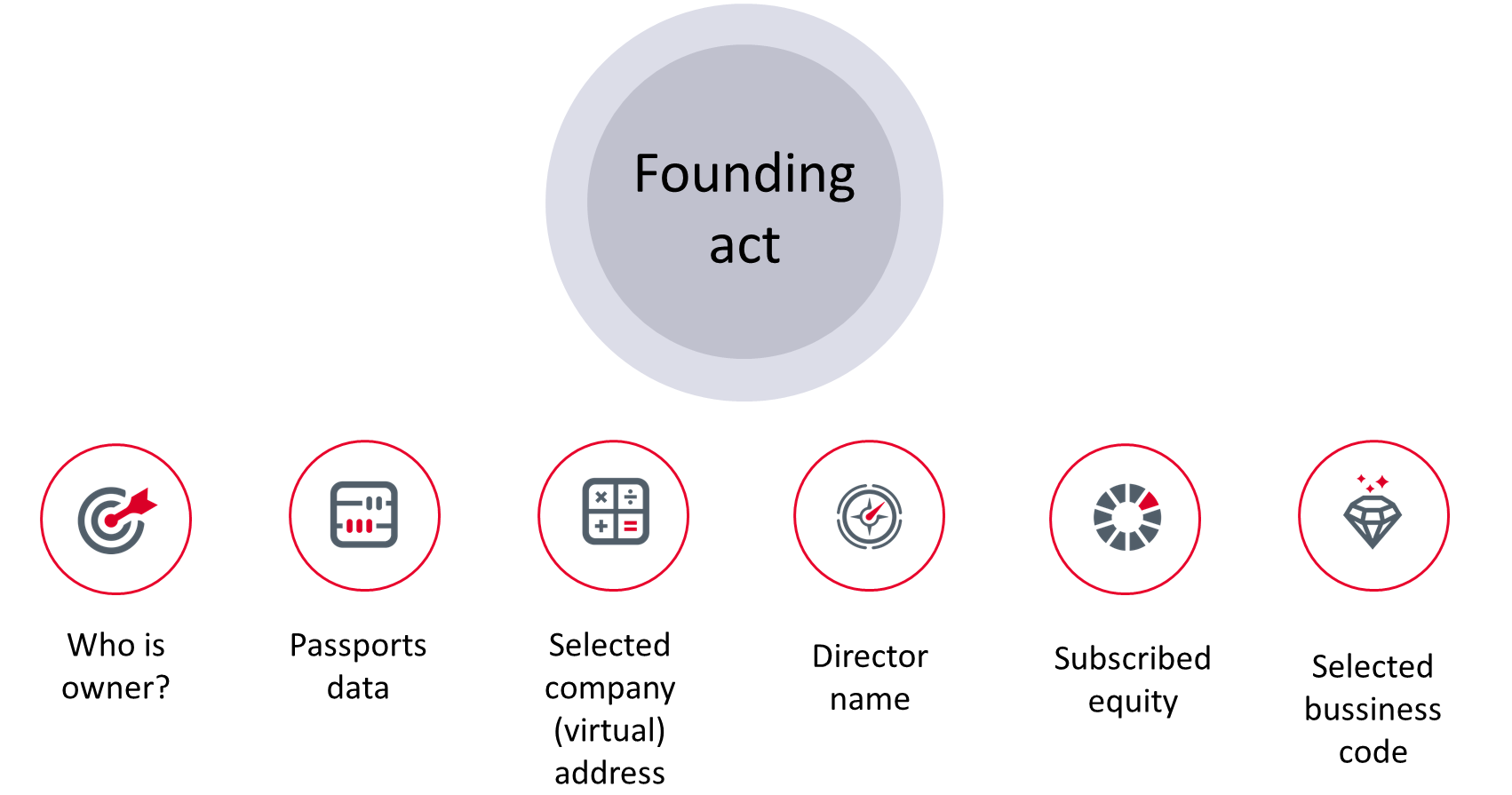

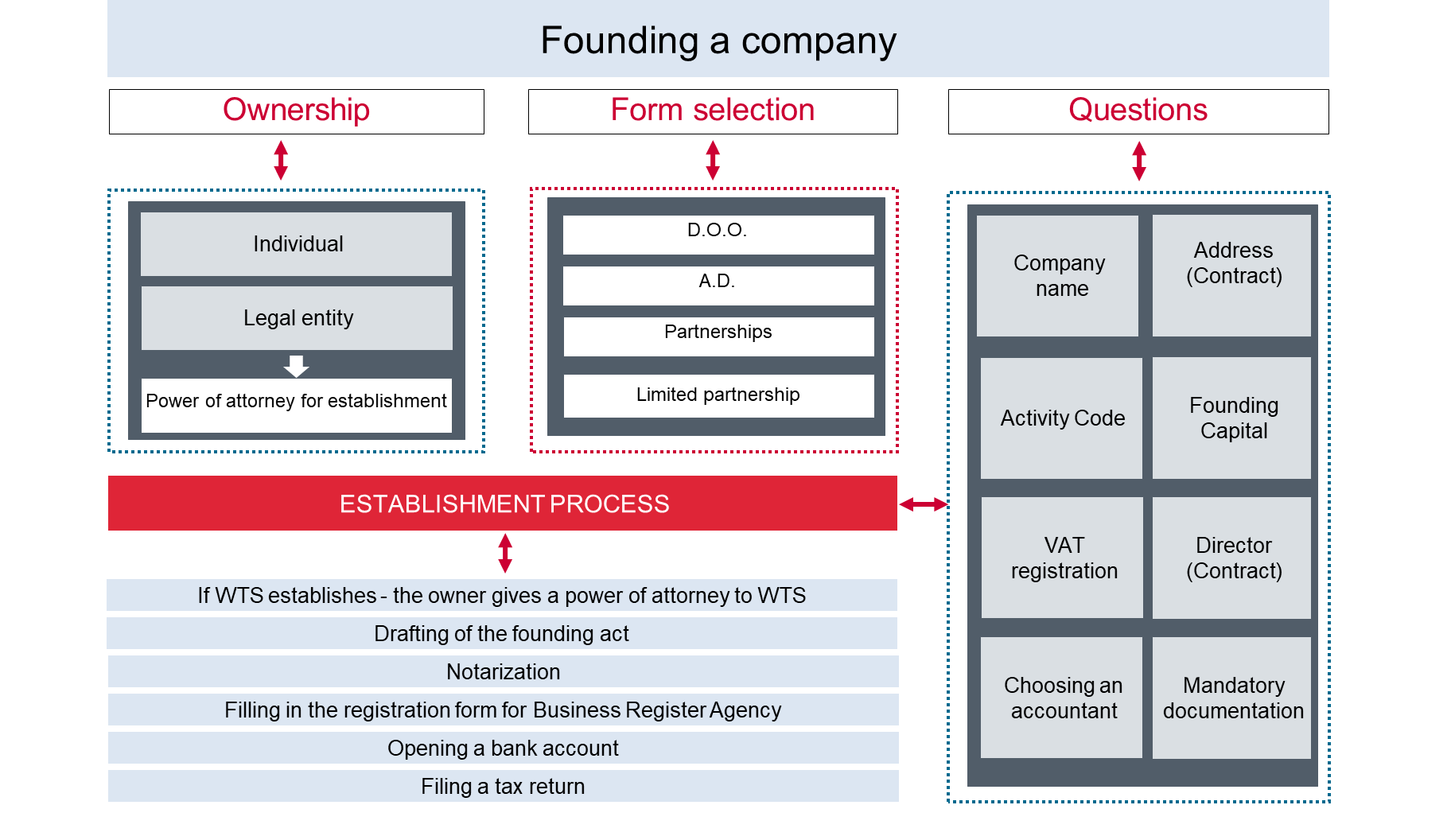

The process of company registration in Serbia begins with decisions:

- who will be empowered for company registration in Serbia (owner or its proxy in Serbia)

- what legal form is selected (please see explanation of all legal forms below in text)

- who will be the owner (legal entity or individuals)

- what is business activity and business code

- what would be registered address

- what is subscribed equity

- who is legal representative of company

- would the company wishes to be automatically registered in VAT in Serbia

- what are expected revenues and expenses in first year of operations

After collecting of the above information, the Founding act should be prepared and stamped by official notary office. In a case you grant Power of Attorney to the local experts, there is no need for physical presence in Serbia.

The owner should provide evidence such as passport (in a case the individual is owner) or extract from official register (in a case legal entity is owner). Passport should be provided also by legal representative of company.

Next step of company registration in Serbia is filling registration form provided by Serbian Business Register Agency. Administration tax to be paid to Serbian Business Register Agency is approximately 50 EUR.

In case fonder wishes to empower a proxy for company registration in Serbia, Power of Attorney is mandatory.

For support in company registration in Serbia, or if you have any questions how to open company in Serbia please contact our legal team.

SEE ALSO: HOW TO SET UP ACCOUNTING IN NEW COMPANY IN SERBIA.

Legal forms of company registration in Serbia

According to the Serbian Law on Business Entities there are four legal forms for company registration in Serbia:

- General Partnership

- Limited Partnership

- Limited Liability Company (the most usual)

- Joint-Stock Company

A company can be incorporated for a limited or unlimited duration. Also, a foreign entity can incorporate a representation office.

General Partnership (o.d.)

A general partnership is a company with two or more partners with unlimited joint and several liability for the company’s obligations with their entire assets.

The company name must include the words “ortačko društvo” or the abbreviations “o.d.” or “od”.

All partners sign the Foundation Agreement. Partners invest the same stake in a company and share profits equally, unless regulated differently by the Foundation Agreement.

Decisions are adopted unanimously (“one partner = one vote” rule), unless regulated differently by the Foundation Agreement.

General partnerships prepare annual financial statements and are subject to corporate income tax. There are no minimum basic capital requirements.

Limited Partnership (k.d.)

A limited partnership is a company with a minimum of two members, at least one of which bears unlimited joint and several liability for the company’s obligations (general partner) and at least one other bears limited liability up to the amount of their outstanding contribution (limited partner).

The company name must include the words ‘’komanditno društvo’’ or the abbreviations “k.d.” or “kd”. General partners manage the operations of and represent a company. Limited partners may not manage the operations of a company or represent it.

Partners sign the Foundation Agreement, in which it is defined who the general partner is and who the limited partner is. Limited partners and general partners participate in sharing profits and covering losses in their company in proportion to their equity interests in the company, unless otherwise provided for by the deed of incorporation.

Limited partnerships prepare annual financial statements and are subject to corporate income tax. There are no minimum capital requirements.

Limited Liability Company (d.o.o.)

For company registration in Serbia, a limited liability company is the most popular form. This is a company in which one or more company members hold equity interests in the company’s share capital, except that company members are not liable for the company’s obligations, apart from in special circumstances defined by the Act on Business Entities.

The company name must include the words “društvo sa ograničenom odgovornošću” or the abbreviations “d.o.o.” or “doo”.

It is the most common legal form of company in Serbia because of the limited liability of its founders and low capital requirement (minimum basic capital is RSD 100, i.e. less than EUR 1).

If one person incorporates a company they sign a Foundation Decision. If two or more people incorporate a company, they sign a Foundation Agreement.

The company founders (or members) constitute the Assembly, which makes the statutory decisions. Their voting rights and rights in sharing profits are proportional to their stake in the company’s capital, unless otherwise regulated by the Foundation Act.

For a decision to be adopted, 50% plus 1 vote is needed, unless otherwise regulated by the Foundation Act.

The company’s business activities are managed by a director or directors, who are registered at the Business Register Agency. Directors may or may not be company members.

Limited liability companies prepare annual financial statements and are subject to corporate income tax.

A joint-stock company

The registration of joint-stock company in Serbia is the most complex comparing with other forms. A joint-stock company is a company whose share capital is divided into shares held by one or more shareholders who are not liable for the company’s obligations, except in special circumstances, as defined by the Act on Business Entities.

If a joint-stock company’s shares are listed on the stock exchange, it is called a public joint-stock company. If a joint-stock company’s shares are not listed on the stock exchange, it is called a private joint-stock company.

The company name must include the words “akcionarsko društvo” or the abbreviations “a.d.” or “ad”.

The company’s shareholders sign the Foundation Act and the Statutory Act upon the company’s incorporation.

The shareholders constitute the Shareholders’ Assembly, which makes the statutory decisions. Their voting rights and rights in sharing profits are proportional to their share in the company’s capital.

The minimum basic capital is RSD 3,000,000 (around EUR 25,000). Corporate governance can be one-tier and two-tier. In the one-tier model of governance, the Shareholders’ Assembly elects a Board of Directors, which consists of executive directors who manage the business operations, and non-executive directors (obligatory if a company is a public joint-stock company), who control the executive directors, consult on the company’s business strategy and monitor strategy implementation.

In the two-tier model of governance, the Shareholders’ Assembly elects a Supervisory Board, which elects and controls the Executive Board, comprising the executive directors who manage the business operations.

Financial audit requirement

For joint-stock company a financial statements must be audited.

In regard with other forms, there is a legal requirement for an audit of the financial statements if the company generates more than EUR 4.4 million of revenue in a year, or is classified as a large or medium-sized entity, according to the Act on Accounting.

SEE ALSO: HOW TO MAKE VAT REGISTRATION IN SERBIA

COVID-19 practice

Although the legal preconditions for the establishment of a company have not changed, the practice during the state of emergency has built new rules relevant for the establishment of a company.

After the Government of the Republic of Serbia made a Decision on state of emergency and the Regulation on the organization of work during the state of emergency, the Law on general administrative procedure gained in importance. According the Law on general administrative procedure communication with the state administration can be done by post office or electronically.

Although the counters of the Business Registers Agency were not open to public, communication with the Agency could proceed smoothly by post office or e-mails.

One of the novelties that appeared in practice is the verification of the signatures of the founders – foreign citizens by public notary. The public notary agreed to verify the signatures of the founders only if founders – foreign citizens have spent some time in the Republic of Serbia.

Another novelty that has appeared in practice is the mandatory submission of a business plan when opening business accounts at bank.

More about opening of company in Serbia you can see directly on Business Register Agency portal.

Bank Requirements

During the state of emergency it was impossible for foreign citizens – legal representatives to come in Serbia and sign at bank the necessary documentation for opening an account. In such case some banks internally decided that the account can be opened through a proxy, only if the business plan of the newly established company is also submitted to the bank.

The reason for such a practice is the fear of banks that individuals could set up a company during a state of emergency through which they would launder money and close it in a short period of time.

We will inform you regularly on our blog about all new things that are relevant for founding a company in Serbia.

IF YOU WANT TO REGISTER COMPANY IN SERBIA, GET FREE CONSULTATION IN TERM O LEGAL AND TAX ASPECTS TODAY.