In this article you will discover how you can evaluate your business supported with our business valuation services. You want to know what is the worth of your business, you want to sell or buy the business?

Our approach begins with identification of all factors that impact on business worth and advices how to improve them. We trust that value based management is essential approach in long term business strategy.

The story of our top business valuation consultant

When I was a small boy, I used to sit in my father’s office from time to time. It was a spacious conference room with leather armchairs. I still remember how comfortable they were. Also, I remember the pictures of business office buildings dad’s construction firm worked on. There was a large black desk, always cold, but in a soothing way, under fingers. Probably since that time, my ambition has been to be involved in finance in some way.

In high school, I tried to watch every single business/finance movie. Of course, I watched Wall Street movies. Unlike most people, I prefer the sequel to the original. Money Never Sleeps may be less iconic, but it shows how your business decisions affect your personal life and relationships. It’s (usually) not just business.

One of the scenes I liked is between Shia LaBeouf and Josh Brolin, when Shia’s character asks Josh’s what’s his number:

– ‘’Your number. The amount of money you would need to just walk away and leave. I find that everyone has a number and usually, it is an exact number, so what’s yours?’’

– ‘’More.’’

Have you ever considered selling your business and walking away? You may go pursue another venture, profit-oriented or not. Or retire or go on sabbatical. We may not know your number, but we can assess what is the number of your business. That is the purpose of business valuation services we provide – to assess for how much money you could sell your business.

Even if you are not planning to sell your business right now, it is good to know how much it could be worth it. And to know how you can increase the value. Panta Rei. Everything changes. You can always change your mind.

Business valuation services – how to value a company from London?

There are three basic approaches in the valuation of a business:

- Cost approach

- Market approach

- Income approach

Let’s make a simple example in order to explain them. You earn a small fortune and decide to invest the money. Let’s say that you invest in a fancy apartment in South Kensington in London through a limited liability company. We shall call it Queen Victoria LLC. The only asset of Queen Victoria LLC is the apartment. Queen Victoria LLC has zero debt. Therefore, the value of Queen Victoria LLC equals the value of the apartment in this case. How do you value the company?

Cost approach in valuation

Value according to the cost approach is simple. It is a difference between the assets and liabilities. Your accountant opens the books, finds the acquisition value of the apartment, and deducts accumulated depreciation. Since you have zero debt, the value of Queen Victoria LLC is the net acquisition value of the apartment.

The basic advantage of this approach is that it is fairly easy to apply. Also, it is not speculative. The value calculated through a cost approach is hardly inflated. However, this approach does not take into account market conditions. If you value the Queen Victoria LLC each year, the value will depreciate all the way to zero one day. It is hardly realistic for an apartment in an exclusive neighborhood.

Another issue with the cost approach is that it does not take into account many intangibles which are not presented in business books, such as:

- Quality of management

- Innovation abilities

- Corporate brand

- Product brands

- Market reputation

In the digital economy, intangibles provide most of the profit opportunities. Therefore, the value of a company is mostly determined by intangibles it owns and uses.

When it’s best to implement a cost approach?

- The company is in financial difficulties (bankruptcy, reorganization, etc.) – it is not certain that they will be able to do operate with profit in the future

- The company possess high value of fixed and current assets (investment) while return of investment (ROI) is quite low

- Valuing start-ups and other companies which have yet to prove that they are profitable and financially stable

The market approach in valuation

How do we implement a market approach for Queen Victoria LLC? Well, you try to find out if recently there have been any purchases of similar apartments in the same neighborhood. You get the price per square meter in the comparable transaction and then you get the value of the apartment. In our very example, this would probably the best way to value Queen Victoria LLC.

What if you rent your apartment and generate profit? You can get information on companies that rent similar real estate and get information on their market value (on a stock exchange or in realized transactions). If the value of comparable companies is on average 6 times net profit, then the value of Victoria LLC is 6 times net profit.

The best thing about this approach is that it reflects current market data. Therefore, it comes in handy when you want to realize the sale of your company immediately after valuation. However, there are two main problems:

- Sometimes it is difficult to acquire data on realized transactions, especially in emerging markets

- How to identify comparable companies? As there are no two same men, there are no two same companies. Each company has its own market reputation, brand, corporate culture and identity, and other elements which are crucial factors of company value

Income approach in valuation

This approach is the most usual approach in business valuation services.

How to value Queen Victoria LLC by using the income approach? If you rent the apartment, Queen Victoria LLC will generate cash flows. You project cash flows in the future. Then you decrease the cash flows using a discount rate. The discount rate is the risk rate of your cash flows, i.e. the rate of return (cost of capital) that you let go because you already invested in Queen Victoria LLC. The sum of discounted cash flows is increased for the current cash balance and decreased for debt and you get the value of Queen Victoria LLC.

The income approach is the most common valuation approach in practice. It is used for already established, financially stable companies who are able to generate profit in the future.

The approach enables you to use all information about the company, both qualitative and quantitative. Does your company have a unique brand and innovative abilities? That should be shown in your cash flow projections (revenue growth, EBIT margin, etc.).

The main problem with this approach is that it tends to be speculative. If you project cash flows poorly, you will not get proper company value.

Since the income approach is the most common in practice, in the following parts of the text we will write about the main method of this approach. That is the DCF (Discounted cash flow) method.

Business valuation services – creating the story with the client

How do you know you are reading a company valuation book? You will find a sentence like:

Valuation is an art, not a science.

But what does it mean?

Valuation is based on assumptions and guessing of the future. Any calculated value is a subjective opinion of a certain valuation expert. Two experts may value the same company but come up with totally different results:

- They may apply different valuation approaches and methods

- Even if they use the same valuation approach, they could see the present and future of the company differently (different comparable companies/transactions, different assumptions on cash flows, etc.) and that would lead to different company values.

Aswath Damodaran, the most significant author on valuation today, likes to say that every valuation is a story. It is a story of the future of the company. You cannot project future cash flows with 100% precision, you will miss it. However, you need to make sure you do not miss a lot. You cannot tell the whole future precisely, but please make sure you went in the right direction.

For example, if you value an established company generating billion EUR of annual sales in a mature market, you cannot project a 50% annual growth rate. Each financial assumption you make must be consistent with your story.

When we are engaged in company valuation, the first step is to create the story. After we agree on the story with the client, other issues are of mere technical nature.

All things considered, if you engage a consultant for valuation and he/she comes with the number you did not except, maybe a consultant did the technical part of the job perfectly, but you did not agree on the story.

Business valuation services – DCF method

The essence of the DCF method is to make financial projections for a 5-10 year period and to discount them by the cost of capital.

In the following example, we project the cash flows of a service company for the next 6 years:

| No |

Category (in EUR) |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

| 1 |

Revenue |

2.000.000 |

2.400.000 |

2.880.000 |

3.456.000 |

4.147.200 |

4.976.640 |

| 2 |

EBIT margin |

5,00% |

6,50% |

7,00% |

9,00% |

10,00% |

10,00% |

| 3 = 1*2 |

EBIT |

100.000 |

156.000 |

201.600 |

311.040 |

414.720 |

497.664 |

| 4 |

Corporate income tax |

15.000 |

23.400 |

30.240 |

46.656 |

62.208 |

74.650 |

| 5 = 3 – 4 |

NOPAT |

85.000 |

132.600 |

171.360 |

264.384 |

352.512 |

423.014 |

| 6 |

Depreciation costs |

20.000 |

24.000 |

28.800 |

34.560 |

41.472 |

49.766 |

| 7 |

Capital expenditures |

30.000 |

33.000 |

36.300 |

39.930 |

43.923 |

48.315 |

| 8 |

Networking capital expenditures |

60.000 |

66.000 |

72.600 |

79.860 |

87.846 |

96.631 |

| 9 = 5 + 6 – 7 – 8 |

FCFF |

15.000 |

57.600 |

91.260 |

179.154 |

262.215 |

327.835 |

| 10 |

Discount rate |

1,15 |

1,32 |

1,52 |

1,75 |

2,01 |

2,31 |

| 11 = 9/10 |

Present value of FCFF |

13.043 |

43.554 |

60.005 |

102.432 |

130.367 |

141.732 |

On the basis of projected revenue and profit margin, we calculated operating income (EBIT – Earnings before interest and taxes) for each year. EBIT less corporate income tax equals NOPAT (Net operating profit after taxes). NOPAT is increased for depreciation costs (since these expenses do not lead to cash outflow) and then decreased for capital expenditures and net working capital expenditures. In that way, we get to FCFF. FCFF is free cash flow to the firm, i.e. cash flows left for company owners and creditors after all expenses and investments are covered.

By dividing FCFF with the discount rate, we get the present value of FCFF.

Calculation of company value is presented in the following table:

| No |

Category |

Amount (EUR) |

| 1 |

Present value of FCFF 2021 – 2026 |

491.133 |

| 2 |

Residual value |

821.635 |

| 3 |

Debt balance on the day of valuation |

200.000 |

| 4 |

Cash balance on the day of valuation |

50.000 |

| 5 = 1 + 2 – 3 + 4 |

Value of the company |

1.162.769 |

The present value of FCFF 2020 – 2025 is the sum of amounts from the first table under row No 11. It is then increased for residual value (the present value of cash flows after 2026) and cash balance on the valuation day, as well as decreased for debt balance on the valuation day. Therefore, the estimated value of the company is approximately 1.200.000 EUR.

Let’ say that 100% equity of this company was sold for 1.162.769 EUR. How do we interpret it?:

The present value of the cash flows the company will generate is 1.162.769 EUR. The owner has two options with the same present value: to sell the business for a written amount now or to keep the business which will generate projected cash flows for him/her.

Business valuation services – enhancing the value of the company

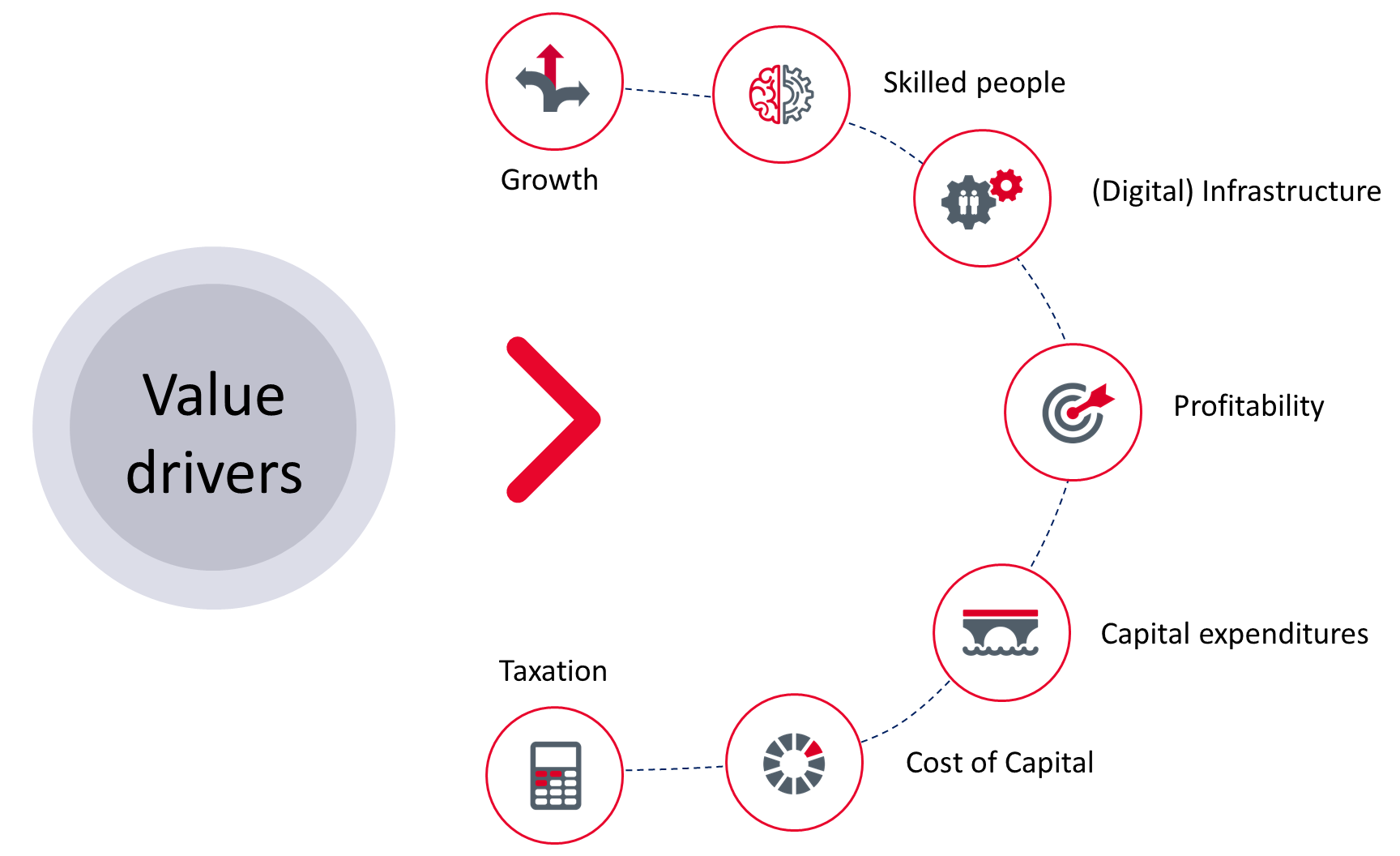

Business valuation may be used for making strategic decisions, whether you plan to sell your company or not. To maximize your own net worth, you need to maximize the long-term cash flows of your business. The process of maximizing the long-term cash flows of the business is called value enhancement. The essence of value enhancement is to focus on value drivers (key variables that affect the value of the business):

- Sales growth: is there a potential for growth of the existing product portfolio? Could you introduce new products/services for existing or new customers?

- Higher profitability: could you make cost savings? What are the main reasons for inefficiencies in your business?

- Lowering the effective tax rate: could you achieve tax optimization? Is there a possibility to gain tax incentives?

- Lower capital expenditures: could you generate projected cash flows with less investment? Is there any asset that does not help in generating operating cash flows? Could you sell those assets?

- Lowering the cost of capital: is your financing structure harmonized with your ambitions and risks? What are the main risks in your business? How to react to those risks?

Business valuation services – money never sleeps

You value a company and you get a certain number. One year later, an investor calls you and wants to buy your business. What price are you going to offer? Will you tell him/her the number from your valuation?

As we said before, each valuation is a story. You need to ask yourself whether a story has changed in the last 12 months. If you are in the airline business and you projected strong sales growth, that story is hard to be true because of Covid – 19 pandemic.

The different story leads to different projections. Different projections lead to a different value.

If your business is private, the business valuation process is a substitute for the stock exchange. It shows the market value of your business. The market value of each business changes from day today. Money never sleeps. It goes from one hand to another, from one sector to another, one business to another. Or as Gordon Gekko from Wall Street said it:

‘’Money itself isn’t lost or made, it’s simply transferred from one perception to another, like magic. This painting here. I bought it ten years ago for $60,000. I could sell it today for six hundred. The illusion has become real. And the more real it becomes, the more desperate they want it. Capitalism at its finest.’’

Business valuation services – our expertise

WTS Serbia has provided business valuation services to companies of different sizes and different sectors. Business valuation services include the following activities:

- Analyzing business model and the story of your business; projecting cash flows with your assistance

- Choosing the valuation approach and method

- Estimating the cost of capital

- Presenting estimated value through a written report or verbally

- Discussing results and amending them if necessary, in accordance with your recommendations and suggestions

- Interpreting valuation results to third parties

We hope this article was both interesting and helpful in understanding business valuation services. In case you need professional support in the valuation process, do not hesitate to write to our consultants.